Here’s where things started to go wrong:

1) Capitalism is not Wall Street, yet over the past few decades we have allowed western capitalism to be defined by Wall Street insiders and their ever expanding need to bump the scheme to the next tier to avoid a collapse and allow them to continue ‘skimming’ huge “profits”.

2) Here are some of the contributing factors that allowed this to happen and why it continues:

a. With the best of intentions, in the mid 1960s President Johnson managed to pass social legislation launching his Great Society reforms.

b. What for 150 years had been seen as the ‘privileges’ of living in a free society became ‘rights’ (entitlements) to which that society has been held hostage ever since.

c. For the first time in US history (except in time of war) the law was changed to allow deficit spending to fund these programs, creating an overhang of sovereign debt that just keeps growing and will never go away.

d. As expenses for social programs increased, and the consequences of out-year funding began to loom large, public and pension fund monies began shifting to riskier and riskier investment strategies, moving from safe income producing securities to other equities hoping for higher returns through capital appreciation—like desperate unemployed households going to Las Vegas with the few bucks they have left to roll the dice—Wall Street welcomed them with open arms.

i. Safe investment=I pay you X, you pay me Y at periodic intervals for as long as I hold the stock=fixed income strategy (dividends)

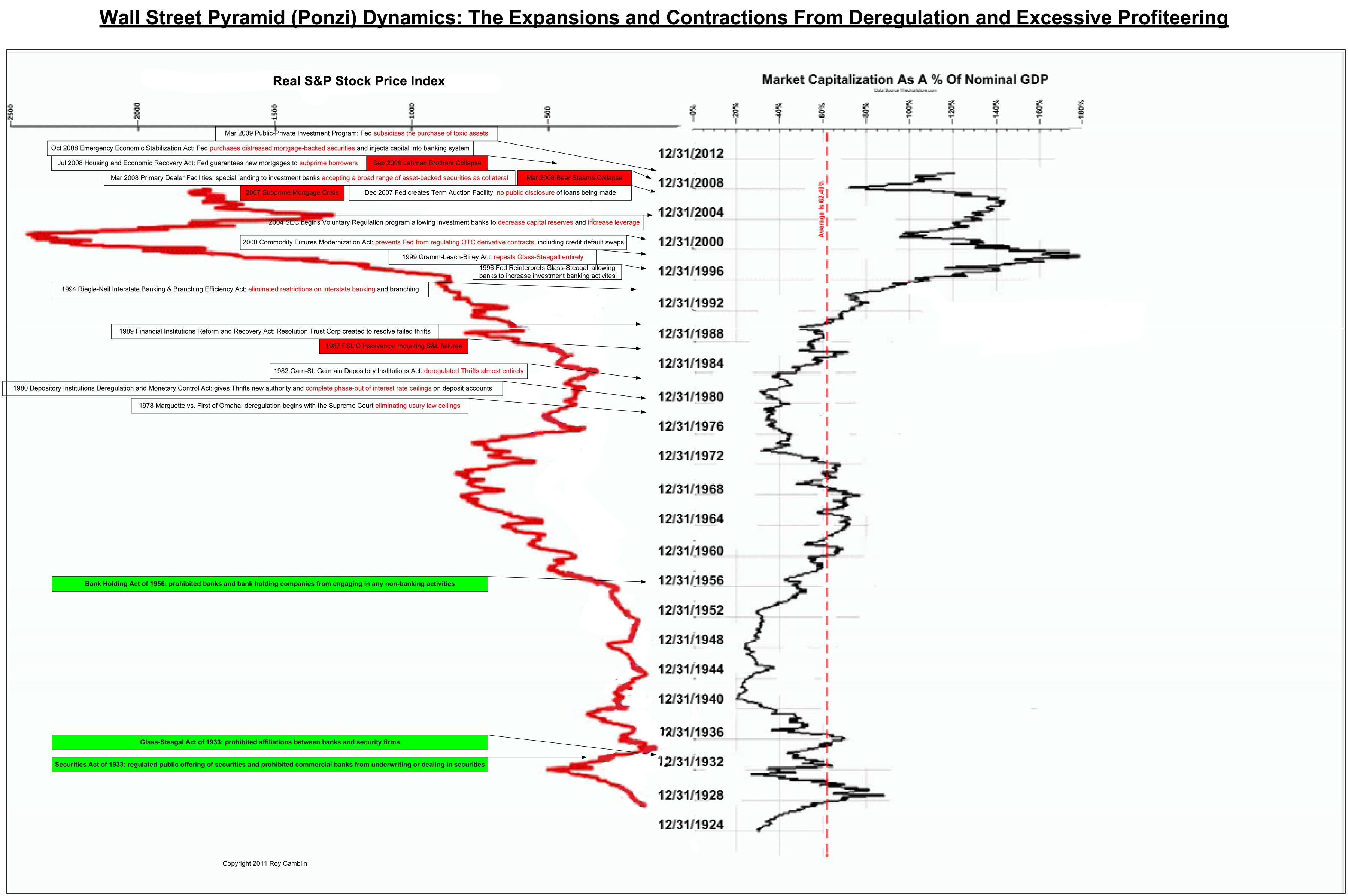

ii. Risky investment=I pay you X and hope some later investor will pay me X++=capital appreciation strategy (pyramid/Ponzi scheme)

e. With these investments of public monies, suddenly city, state, and even federal governments (i.e. legislatures) had a vested interest in keeping the whole thing afloat. The stage was set for a lot of bad behavior at all levels of public administration.

i. Wall Street was now in a position of leverage and could make demands that would have been unconscionable just a few years earlier.

ii. One by one the laws that were created (Banking Act of 1933 and others) to protect all of us from the ravages of market speculation have been repealed or eroded to allow more money to come in—rising market caps giving us a false sense of prosperity—economists going into overdrive to rationalize it for the public, Copernican practitioners at their best.

f. As this shift occurred and Wall Street became the master of our economy, the profile of CEOs running companies shifted to better serve Wall Street interests:

i. CEOs must now be “street credible”—willing to do anything necessary to make the numbers regardless of social consequences—recruited more for their flash and dash than their ability to run a business, and they’re rewarded with exorbitant sums of money for simply creating higher market caps, not anything of rear social or economic value.

ii. Board advocates for the employee and the customer have become almost non-existent…it’s all about serving Wall Street now.

iii. Current CEOs and boards will argue otherwise, but look at what they demonstrate (layoffs, off-shoring, etc), not what they say—there’s a huge gap between their walk and talk. Our unemployment numbers are the smoking gun.

3) There was a time when capital appreciation wasn’t what drove investing, regular dividends where what was expected.

4) There was a turning point in the capital markets several decades ago when capital suddenly became ‘free’ (no requirement for dividends) and all that was expected from a company was to provide periodic news to entice new investors into the current investment tier lifting it to the next level of the upside down wedding cake (classic pyramid/Ponzi dynamics).

Here’s a construct (still a work in progress) that we’ll be using in later discussions: